nevada estate tax rate 2021

Rates include state county and city taxes. The Auditor-Controller Property Tax Division is responsible for the calculation and preparation of the secured unsecured unitary and supplemental property tax bills.

Nevada Tax Rates And Benefits Living In Nevada Saves Money

NRS 361453 has further capped the rate at 364 per 10000 of.

. Tax District 200 Tax Rate 32782 per hundred dollars. NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. 200000 taxable value x 35.

Detailed Nevada state income tax rates and brackets are available on this page. In 2022 it rises to 1206 million. Statutory Tax Rate Limit The Nevada State Constitution caps the property tax rate at 500 per 10000 of assessed value.

All Major Categories Covered. 2021 Nevada State Sales Tax Rates The list below details the localities in Nevada with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Value of estate.

2020 rates included for use while preparing your income tax. In 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or less. Under Nevada law there are no inheritance or estate taxes.

The rate jumps to 15 percent on capital gains if their income is 40401 to 445850. The states average effective property tax rate is just 053. Select Popular Legal Forms Packages of Any Category.

Nevada repealed its estate tax also called a pick-up. Federal Estate Tax Rates for 2022. Washington estate tax rate 2021 Up to 2193000.

The estate tax is a tax on a persons assets after death. Nevada has a 685 percent state sales tax rate a max local. Over 3193000 to 4193000.

Determine the assessed value by multiplying the taxable value by the assessment ratio. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Over 2193000 to 3193000.

Personal Property Manual. 084 of home value. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000.

The Nevada income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022. Homeowners in Nevada are protected from steep increases in. To make things simple if your estate is worth 1206 million or less you dont need to worry about the federal estate tax.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. So even though Nevada does not have an estate tax gift tax or inheritance tax it does not mean that. Ad From Fisher Investments 40 years managing money and helping thousands of families.

For more information contact the Department at 775-684-2000. Nevada does not have a corporate income tax but does levy a gross receipts tax. You may find this information in Property.

Statutory Tax Rate Limit The Nevada State Constitution caps the property tax rate at 500 per 10000 of assessed value. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Ad Instant Download and Complete your Probate Forms Start Now.

In 2021 federal estate tax generally applies to assets over 117 million. Tax amount varies by county. Valuation Guidelines 2021-2022 Department of Taxation Division of Local Government Services 1550 College Parkway Suite 144 Carson City.

But Nevada does have a relatively high sales tax a state rate is around 7 but goes to approximately 8 when you consider local tax rates. Nevada does not have an individual income tax. It is one of the 38 states that does not apply an estate tax.

Compared to the 107 national average that rate is quite low. 31 rows The latest sales tax rates for cities in Nevada NV state. NRS 361453 has further capped the rate at 364 per 10000 of.

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax Credit Nevada that was collected prior to January 1 2005.

State Local Property Tax Collections Per Capita Tax Foundation

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

How To File Taxes For Free In 2022 Money

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Mortgage Application Checklist For Pre Qualification Mortgage Checklist Mortgage Marketing Mortgage Loan Officer

2022 State Income Tax Rankings Tax Foundation

2022 Filing Taxes Guide Everything You Need To Know

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Free Online Appraisal Service Of Native American Art And Artifacts By Matt Wood S Aaia Inc Native American Art American Art Native American Kachina Dolls

Property Tax Comparison By State For Cross State Businesses

County Surcharge On General Excise And Use Tax Department Of Taxation

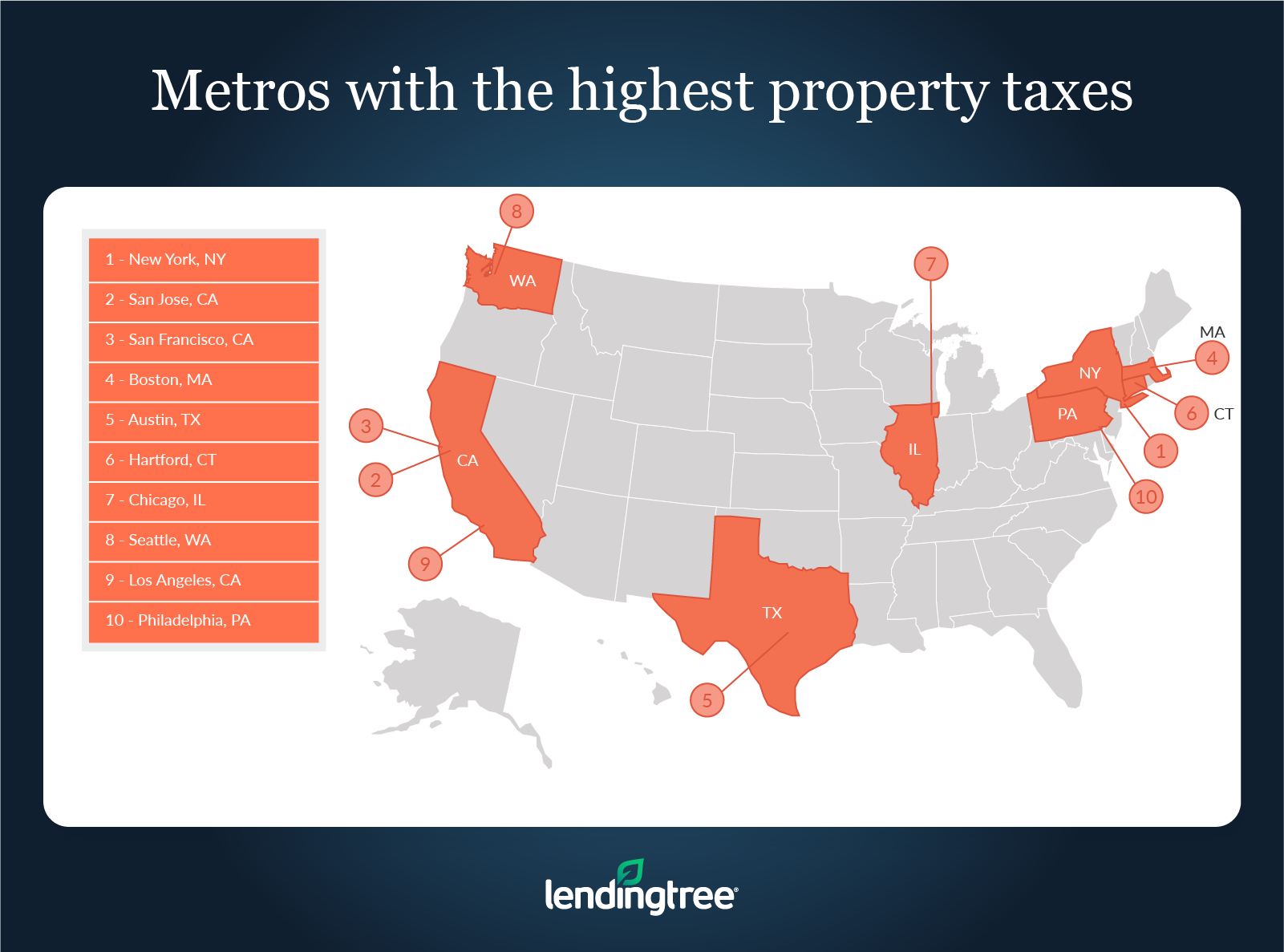

Where People Pay Lowest Highest Property Taxes Lendingtree

How And Why To Get Pre Approved For A Mortgage In 2021 Preapproved Mortgage Buying First Home First Home Buyer

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Most Expensive U S Zip Codes In 2021 10 Areas Surpass 4 Million Median Sale Price Coding Zip Code Home Buying

Mapped The Cost Of Health Insurance In Each Us State Travel Insurance Healthcare Costs Medical Insurance

Qualify For Deductions When You Buy A Home In Las Vegas Nevada Home Buying Real Estate Smart Money