michigan sales tax exemption number

Ranked 21st highest by per capita revenue from the statewide sales tax 852 per capita Michigan has a statewide sales tax rate of 6 which has been in place since 1933. Warren Schauer Michigan State University Extension - March 20 2013.

Forms and exemption certificates can be found at Tax Services Forms Download web page.

. Municipal governments in Michigan are also allowed to collect a local-option sales tax that ranges from 0 to 0 across the state with an average local tax of NA for a. Sellers should not accept a number as evidence of exemption from sales or use tax. Purchases or payment of services must be made directly from Michigan State University in order to claim exemption.

In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. CST on Monday through Friday. You can easily acquire your Michigan Sales Tax License online using the Michigan Business One Stop website.

All claims are subject to audit. You can also find form SS-4 on the IRS website. Enter Sales Tax License Number.

The tool will output the status of the resale certificate within a few seconds. A purchaser who claims exemption for resale at retail or for lease must provide the seller with an exemption certificate and their sales tax license number or use tax registration number. How to use sales tax exemption certificates in Michigan.

A sellers permit is commonly known as a sales tax permit reseller permit resale certificate sales tax exemption certificate sales tax license or sales and use tax permit. To get started click on the Verify a Permit License or Account Now. If you have questions about state sales tax exemptions please contact taxreportingctlrmsuedu or 517-355-5029.

This page discusses various sales tax exemptions in Michigan. Several examples of exemptions to the states. W-9 Form This form is used to provide the legal name and taxpayer identification number for the university.

On the next page use the dropdown menu to select Sellers permit. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Step 4 Indicate the reason for sales tax exemption.

Michigan Sales and Use Tax Certificate of Exemption Fillable Form 3372. Sales Tax Exemption Michigan information registration support. Attached is the universitys license.

A tax exempt number is an identification number issued to you by the state where your business operates. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. In the state of Michigan it is formally referred to as a sales tax license.

You can also apply for a federal tax ID number by phone when you call 800 829-4933. If you are looking to purchase goods in Michigan and you have tax-exempt status you need to fill out this form and present it to the seller at the time of your purchase. All claims are subject to audit.

You present this number to suppliers when you purchase wholesale goods enabling you to avoid sales tax charges. Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions. Michigan does not issue tax-exempt numbers so sellers must have this form in order for you to be granted your.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. The sale of any item should only be taxed once that is when it is purchased by the end user. Direct Pay -Authorized to pay use tax on qualified transactions directly to Michigan Treasury under account number.

All fields must be. Most common agricultural input expenses are exempt from Michigan Sales Tax. For other Michigan sales tax exemption certificates go here.

Visit the IRS website to get started. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Business hours for the phone application system are 7 am.

Sales Tax Exemptions in Michigan. However if provided to the purchaser in. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed.

Michigan State University Extension will often get phone calls from farmers wondering how they can get a tax exempt number so they do not have to pay sales tax. Once you have that you are eligible to issue a resale certificate. Step 5 Fill out the name of the business address phone number signature title and date.

If you have quetions about the online permit application process you can contact the Department of Treasury via the sales tax permit hotline 517 636-6925 or by checking the permit info. Obtain a Michigan Sales Tax License. This license will furnish your business with a unique sales tax number Michigan Sales.

Michigan Sales Tax License If the university sells goods eg. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

Therefore you can complete the 3372 tax exemption certificate form by providing your Michigan Sales Tax Number. It is often given to payors before payment is made to the university. Michigan sales tax and farm exemption.

Get Your Michigan Sales Tax License Online. If a retailer is purchasing merchandise for resale check box number 2 and include their Sales Tax License Number. All claims are subject to audit.

Ad New State Sales Tax Registration. Michigan does not issue tax exemption numbers. While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

Computers T-shirts etc a sales tax license is required. You can then enter the permit Identification Number you want to verify and click the Search button. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed.

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Sales And Use Tax Certificate Of Exemption

Not For Profit Vs For Profit Harbor Compliance Social Enterprise Business Benefit Corporation Social Entrepreneurship

Tax Exempt Status Customer Service Andymark Inc

How Do I Register For A Sales Tax Permit Youtube

Download Policy Brief Template 40 Brief Executive Summary Ms Word

How To Register For A Sales Tax Permit In Michigan Taxvalet

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

![]()

Getaway From The City Cape Ann Relaxing Getaways New England Fall

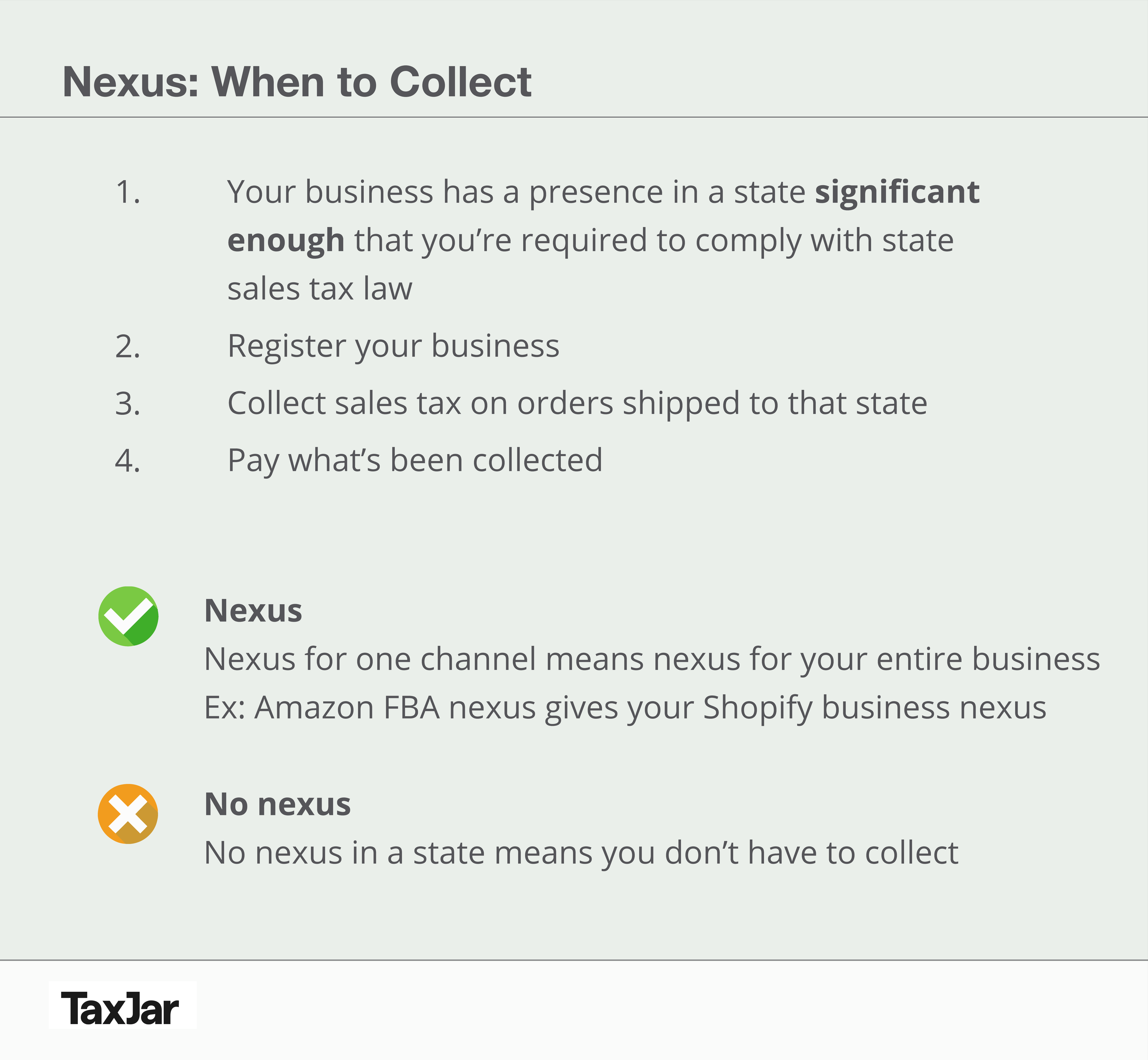

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

![]()

Getaway From The City Cape Ann Relaxing Getaways New England Fall

Individuals Use The Option Of Filing An Amendedtaxreturn When He Or She Comes To Know That There Is An Error In His Al Income Tax Tax Consulting Tax Extension

Michigan Bill Would Allow Expecting Parents To Claim Fetuses As Income Tax Exemptions Free Workout Routines Tax Tax Preparation

Michigan Sales Tax Small Business Guide Truic

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

Business Leaders Think These Are The Best States For Education Business Leader Education Historical Maps